ace listing requirements

Ace market listing requirement Home. The first two amendments mentioned above were the subject of consultation under Consultation Paper No.

Ace Market Enters A New Regulatory Regime The Edge Markets

The Securities Commission Malaysias Prospectus Guidelines is available here.

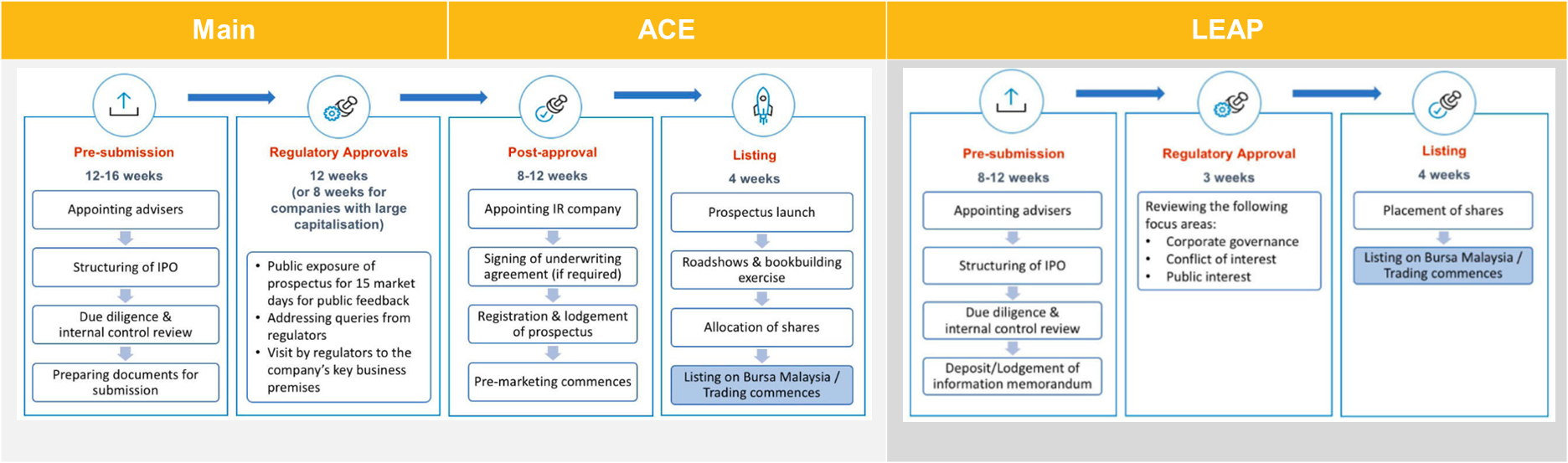

. The Bursa Malaysia Securities Berhad Bursa Malaysia had on 24 March 2016 issued amendments to the Main Market Listing Requirements Main LR and ACE Market Listing Requirements ACE LR collectively referred to as the LR Skip to content. The securities commission malaysia sc and bursa malaysia securities berhad the exchange issued a joint media release on 20 december 2021 announcing amendments to the ace market listing requirements ace lr to enable the exchange to be the sole approving authority or one-stop centre for ace market initial public offerings ipos. 202 Objective of ACE Market 203 Purpose of these Requirements 204 General principles PART B APPLICATION OF THESE REQUIREMENTS 205 Obligation to comply 206 Spirit of these Requirements 207 Waivers and modifications 208 Varying or revoking decisions 209 Guidance Notes PART C DOCUMENTS TO COMPLY WITH THESE REQUIREMENTS.

The company requires 200 public shareholders with holding at least 100 shares where the issuance price at least RM 010. ACE Import Manifest Documentation. Allocation of 125 when enlarging paid-up to Bumiputera investors after 5.

Lawatan Berpandu BM BM. Listing requirements vary by exchange and include minimum stockholders equity a minimum share price and a minimum number of shareholders. The Bursa Malaysia Listing Requirements for ACE Market is available here.

Network Access and Infrastructure Services NAIS Central Depository System CDS Trading Resources. BMSC dan BMDC sebagai Rakan Niaga Pusat CCP Pendedahan PFMI Produk dan Perkhidmatan. 1 Where any one of the percentage ratios of a transaction is 25 or more in addition to the requirements of Rule 1006 the listed corporation.

Sub-Rules 1 and 2 do not apply to a transaction where the value of the consideration of the transaction is less than RM200000. A A listing scheme should be prepared setting out the projected shareholding movements pre-and-post IPO list of promoters substantial shareholders and directors as well as the percentage of shares to be offered by way of private placement and to the domestic public retail market as well as employee share option schemes if any. Requirements ensure that only high-quality securities.

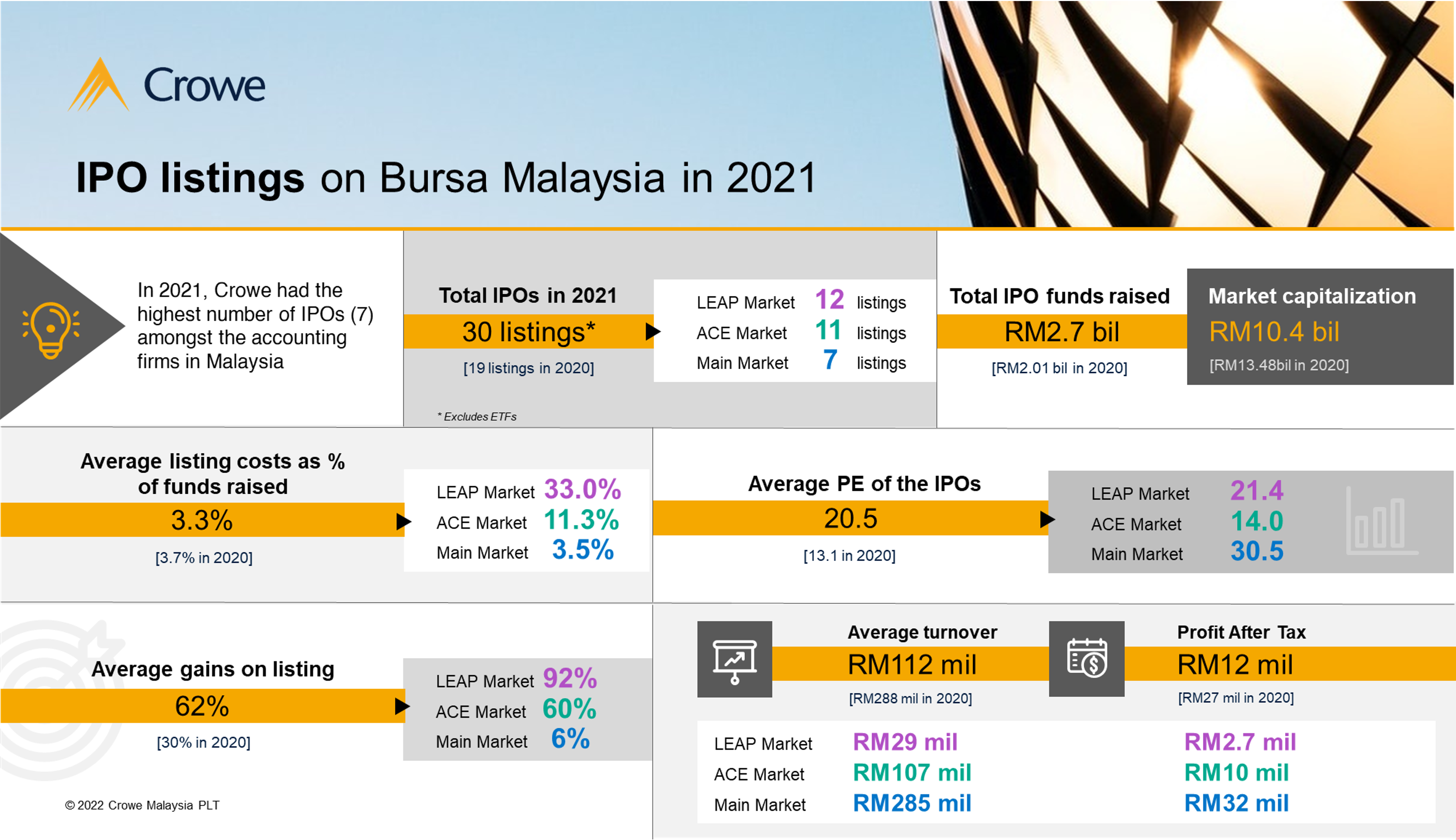

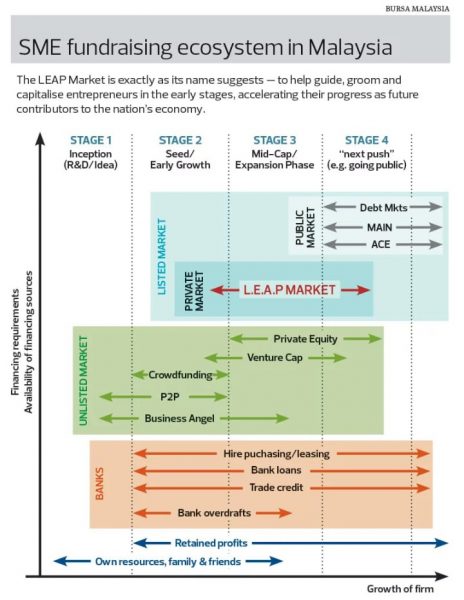

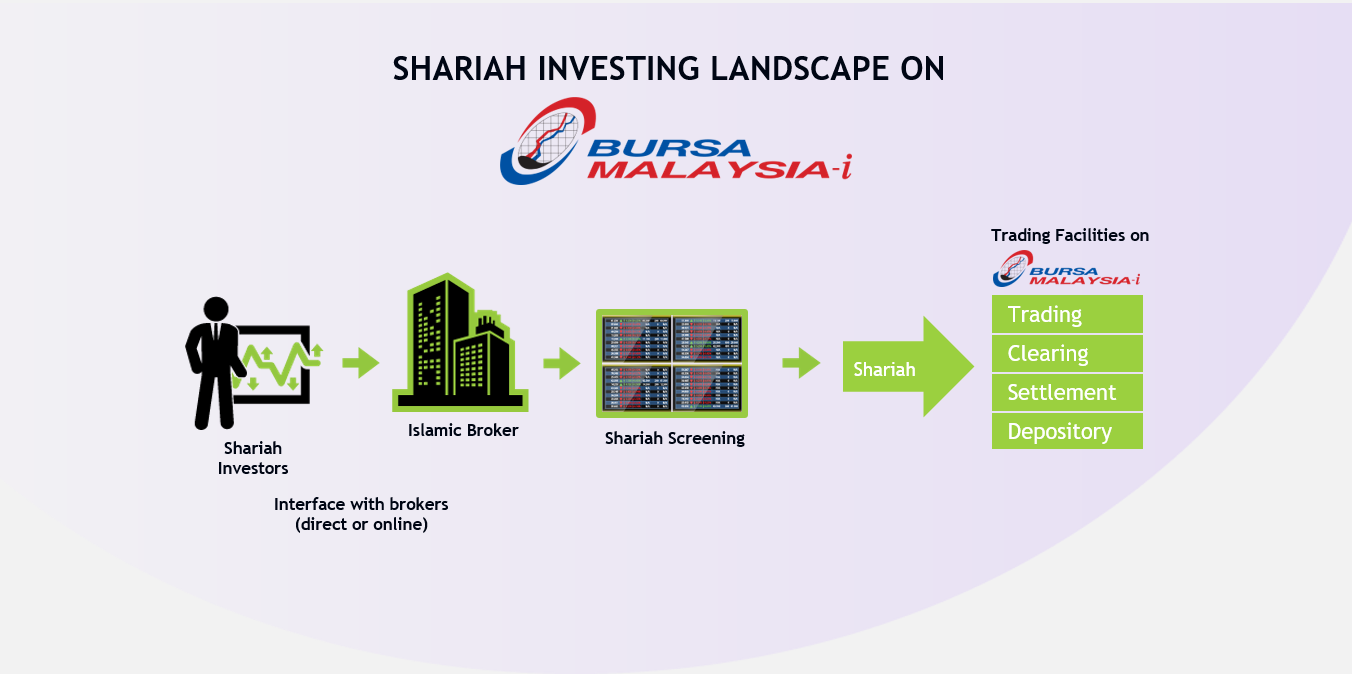

BMSC and BMDC as Central Counterparty CCP PFMI Disclosure Our Product Services. To strengthen the position of Bursa Securities as a conducive capital raising destination the enhanced framework of the MESDAQ Market will be known as ACE Market effective 3 August 2009. For starters unlike Main Market listings there is no requirement of a RM20 million profit track record or market capitalisation requirement.

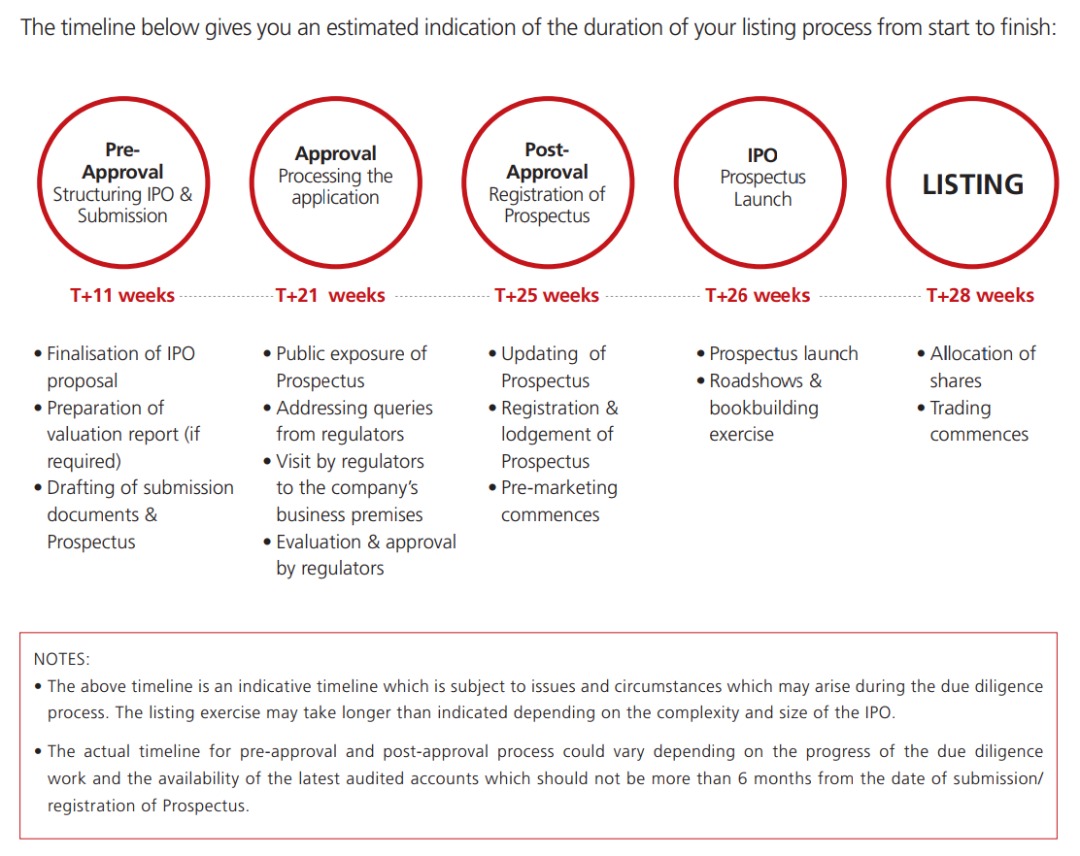

Timeline for listing. Requirements for transactions with percentage ratio of 25 or more. She also explained that unlike the MESDAQ Market the ACE Market allows listing of eligible companies from all sectors instead of only highgrowth or technologybased companies.

12021 on the Proposed Amendments to the Main Market and ACE Market Listing Requirements in relation to Director Appointment and Independence issued by the Exchange on 21 July 2021. 4-6 months with costing of RM 15 million to RM 2 million. Listing Requirements Rules We have clear comprehensive and accessible rules which govern among others the listing of issuers and products on our markets and the obligations of the issuers post-listing the trading clearing and settlement of our products the admission and post admission obligations of our participants.

The third amendment relating to gender diversity was announced. The Bursa Malaysia Listing Requirements for LEAP Market is available here. Primary Listing of Local or Foreign Companies Quantitative Criteria Qualitative Criteria.

Main Market ACE Market. People choose both the ACE and LEAP Markets because their threshold for listing is flexible. Welcome to email protected our all new on-line portal to serve our listed issuers directors of listed issuers and their advisers with regards to interpretation and compliance with the Listing Requirements for the Main and ACE Markets Main ACE LR.

Company Announcements Guided Tour EN. AMS User Requirements CAMIR-AIR - - Detailed technical requirements for submitting data to AMS. These documents contain the technical requirements for submitting documentation to CBPs Automated Commercial Environment ACE via the Automated Broker Interface ABI.

There is no minimum requirement on the operating history size and track record of. Learn more about Malaysias listing markets that are changing effective 3rd August 2009. You are invited to browse our InterActiveLR which has been designed to provide you with a new experience in reading our.

In order to meet the minimum profit requirements of the Main Market a company has to report an uninterrupted profit after tax PAT of three to five full financial years with an aggregate of at least RM20 million including a PAT of at least RM6 million for the most recent full financial year.

Ace Market Easier To List The Star

What You Need To Know Listing At Bursa Malaysia Listing And The Requirements Hills Cheryl

Leap Market One Year On The Edge Markets

Ace Lr Appendix 9b Quarterly Report

Listing Your Company On Bursa Malaysia Crowe Malaysia Plt

What You Need To Know Listing At Bursa Malaysia Listing And The Requirements Hills Cheryl

Perbezaan Main Market Dan Ace Market Mahersaham

Key Requirements For Listing On The Leap Market

Listing Your Company On Bursa Malaysia Crowe Malaysia Plt

What You Need To Know Listing At Bursa Malaysia Listing And The Requirements Hills Cheryl

Investing Leap Market Regulations Aimed At Reducing Investment Risks The Edge Markets

Comments

Post a Comment